This post is part of the New Functionality In Microsoft Dynamics 365 Business Central 2025 Wave 1 series in which I am taking a look at the new functionality introduced in Microsoft Dynamics 365 Business Central 2025 Wave 1.

This post is part of the New Functionality In Microsoft Dynamics 365 Business Central 2025 Wave 1 series in which I am taking a look at the new functionality introduced in Microsoft Dynamics 365 Business Central 2025 Wave 1.

The 2nd of the new functionality in the Country and regional section is define allowed languages per environment.

It’s now easier to select or change the UI language that you’re using. Administrators can save people time and reduce confusion by making only the languages that their environment supports available for selection on the My Settings page.

Enabled for: Users by admins, makers, or analysts

Public Preview: –

General Availability: Apr 2025

Feature Details

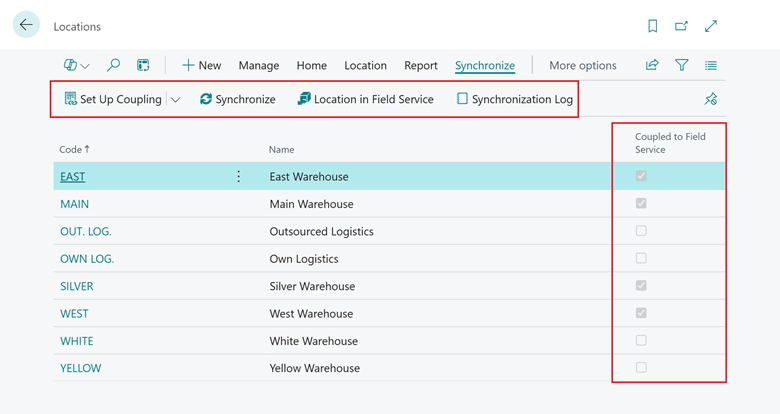

Business Central’s user interface is translated by apps that Microsoft provides, or by language apps that Microsoft’s partners provide on AppSource. Administrators install the language apps in their Business Central environment. Afterward, on the My Settings page, you can choose the language in which you want to use Business Central.

Until now, when you selected your desired language, you chose from the full list of all languages that the Business Central platform can support, regardless of whether a language app is installed for them. This sometimes led to confusing experiences and made it more difficult to select a language. In most cases, only a few languages are relevant for an environment.

Administrators can now use the new Allowed Languages page to define the languages that should show up when people select their language. Showing only the supported languages makes it easier to select a language you can actually use, which helps avoid confusion.

My Opinion

The full list of languages can be confusing to users, so, while a small change, I can see this being useful for those organisations with a dispersed or otherwise multi-lingual workforce.