This post is part of the New Functionality In Microsoft Dynamics 365 Business Central 2024 Wave 2 series in which I am taking a look at the new functionality introduced in Microsoft Dynamics 365 Business Central 2024 Wave 2.

This post is part of the New Functionality In Microsoft Dynamics 365 Business Central 2024 Wave 2 series in which I am taking a look at the new functionality introduced in Microsoft Dynamics 365 Business Central 2024 Wave 2.

The 3rd of the new functionality in the Development section is pull extension source from GitHub when opening Visual Studio Code from the web client.

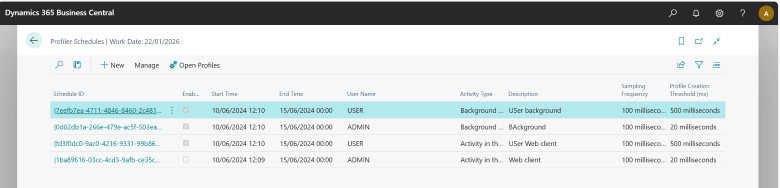

A year ago, you got the power to open a Visual Studio Code project from within the web client. This removed all the hassle of creating projects so you could launch configurations and download symbols yourself. This is a great tool for exploring functionality and troubleshooting, whether it’s in sandboxes or production, and it empowers support, consultants, and developers. However, what if access to extension code is blocked by IP resource exposure protection, but the source is in your GitHub repo? Or maybe you want to proceed with authoring your own code, such as hotfixing one of your apps or pulling the latest source version for changes or development? In 2024 release wave 2, this feature will make that possible.

Enabled for: Admins, makers, marketers, or analysts, automatically

Public Preview: Oct 2024

General Availability: Oct 2024

Feature Details

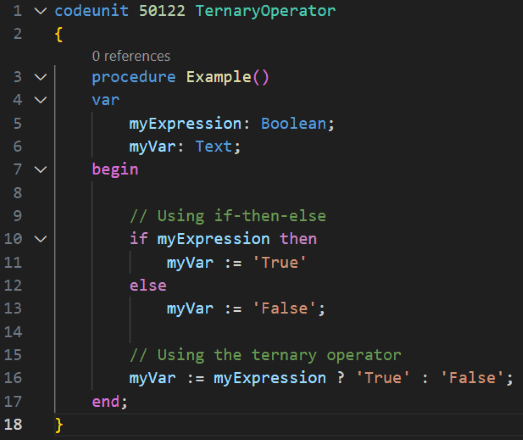

In this release, Microsoft are building on the recent “Explore in Visual Studio Code” feature by using the source and build metadata in the manifest of an extension to offer pulling source from the related GitHub repository and from a specific build. This allows navigating code for the extensions that you have source access to and allows you to hotfix a given build or sync to get the latest changes for investigation or development.

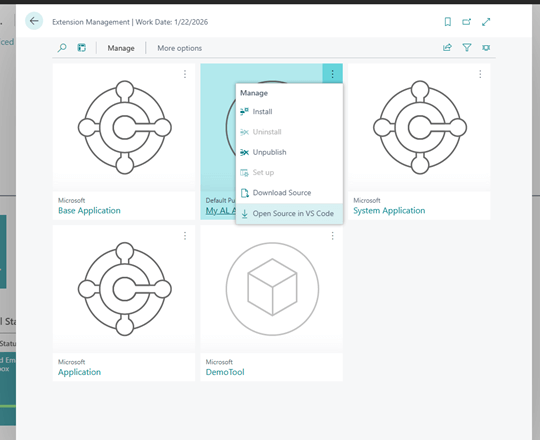

From the Extension Management list page, you now have a new Open Source in VS Code option in the context menu for an extension.

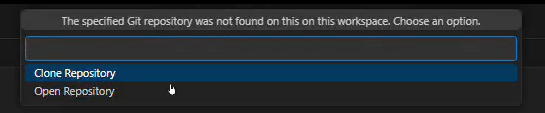

If you invoke that, Visual Studio Code will open and ask you whether to clone or open the GitHub repo for the extension. It will use the repo metadata that was included in the extension when it was built.

You can read more about the source and build metadata in the app.json file here:

.