This post is part of the New Functionality In Microsoft Dynamics 365 Business Central 2024 Wave 2 series in which I am taking a look at the new functionality introduced in Microsoft Dynamics 365 Business Central 2024 Wave 2.

This post is part of the New Functionality In Microsoft Dynamics 365 Business Central 2024 Wave 2 series in which I am taking a look at the new functionality introduced in Microsoft Dynamics 365 Business Central 2024 Wave 2.

The 2nd of the new functionality in the Legislation section is use multiple VAT numbers for a customer.

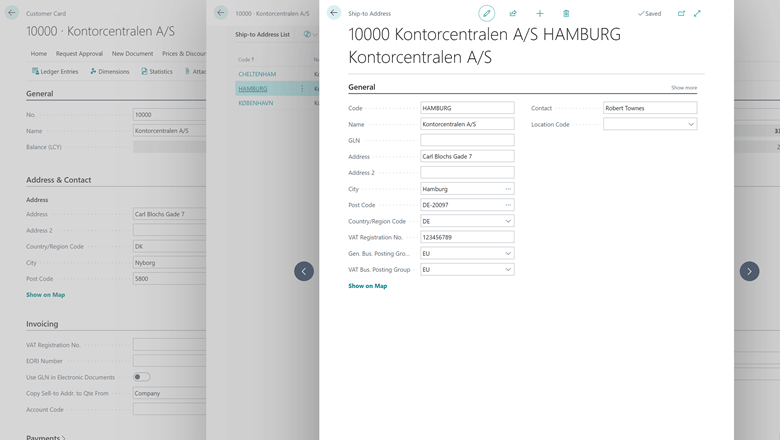

Customers that have warehouses in multiple EU countries probably have a different VAT number for each country. Business Central makes it easy to accommodate that situation. You can set up alternate ship-to addresses for the customers and specify the VAT number to use for those addresses on your sales documents.

Enabled for: Users, automatically

Public Preview: –

General Availability: Oct 2024

Feature Details

Customers that have warehouses in different EU countries must register a new VAT number in each country, which means they have more than one VAT number.

You can add the VAT Number, the VAT Business Posting Group, and the General Business Posting Group to the alternate address for a customer if the address has a different Country/Region Code. When you want to send goods to another address and you select an Alternate Ship-to Address, Business Central shows the appropriate VAT number. You also have the option to use different posting groups.

This feature is available on the following sales documents:

- Sales invoices

- Sales orders

- Sales credit memos

- Sales return orders

My Opinion

This has been a requirement which has come up with a few clients recently, so it is good to see it being introduced into Business Central. It seems odd that it isn’t also available on sales quotes; what will the VAT number be on the order when the quote is converted and an alternative address has been selected?

Click to show/hide the New Functionality In Microsoft Dynamics 365 Business Central 2024 Wave 2 Series Index

What should we write about next?

If there is a topic which fits the typical ones of this site, which you would like to see me write about, please use the form, below, to submit your idea.