This article is part of the In Microsoft Dynamics 365 Business Central (Financial), how do I… series and of the wider In Microsoft Dynamics 365 Business Central, how do I… series which I am posting as I familiarise myself with Microsoft Dynamics 365 Business Central.

This article is part of the In Microsoft Dynamics 365 Business Central (Financial), how do I… series and of the wider In Microsoft Dynamics 365 Business Central, how do I… series which I am posting as I familiarise myself with Microsoft Dynamics 365 Business Central.

in the last article in this series, I took a look at creating the fiscal year using the Create Year process, which works very well if your accounting periods are evenly split into calendar months, but not so good if you use a different structure, such as a 5-4-4 cycle for thirteen week quarters.

In this case, you will need to create the accounting periods manually (or potentially use the create year process and edit the dates afterwards).

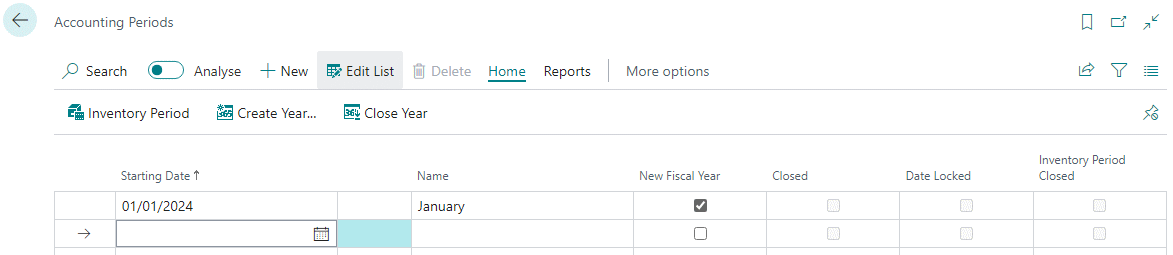

To create a calendar manually, open the Accounting Periods (100) page; enter the Starting Date, the Name will default to the month name, but can be overtyped, and, for the first period of the year, mark the New Fiscal Year checkbox:

Repeat entering each required period; you only need to set the starting date of the period as the ending date is automatically calculated by the system when required. I’d recommend following the period creation of the bulk job by also entering the first period of the subsequent year.

In future, to create new fiscal years, you can follow the same process as outlines above. I generally recommend that clients have the current and next financial years created, which ensures there are no problems when the next year starts and that deferrals can be entered spreading across the financial years.