I helped a client implement the Fixed Asset Management module in Microsoft Dynamics 365 Business Central recently; during training I showed them how to configure and use the module and also created configuration packages for them to import both the fixed asset itself as well as the acquisition and depreciation to date.

I helped a client implement the Fixed Asset Management module in Microsoft Dynamics 365 Business Central recently; during training I showed them how to configure and use the module and also created configuration packages for them to import both the fixed asset itself as well as the acquisition and depreciation to date.

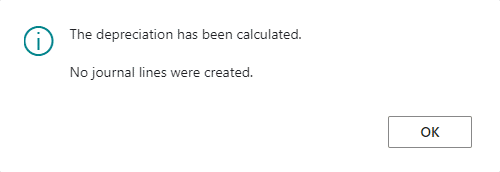

After importing the assets into Business Central with a net book value up to the last day of the previous month, they tried to run depreciation for the assets, but encountered a problem where no depreciation was calculated:

They keyed a new asset onto the system and tried depreciation and that asset did depreciate so there was obviously no general problem with the setup of the module, depreciation book or assets.

Looking at the data in the table, there was no obvious difference between them; there were a few fields different such as dates, values and similar in the Fixed Asset (5600) and FA Depreciation Book (5612) tables, but nothing which would impact the depreciation. It actually took a colleague to spot the difference, as I was reading the field as being the net book value (which is actually in the Book Value field, but was in fact the Ending Book Value field, which is used to set a residual amount for depreciation, below which the asset won’t depreciate.

When the client populated the configuration package, they had not remembered my mentioning this field during training, and for what it was intended, and entered the same value in both the Book Value and Ending Book Value fields, so Business Central was treating the assets as depreciated as far as they should depreciate. A quick configuration package update to the Ending book Value and the assets were able to be depreciated as required.