While I no longer deal with Microsoft Dynamics GP myself, since my move to working with Microsoft Dynamics 365 Business Central, but I do still know a lot of people who work with Dynamics GP.

While I no longer deal with Microsoft Dynamics GP myself, since my move to working with Microsoft Dynamics 365 Business Central, but I do still know a lot of people who work with Dynamics GP.

I received a call from one of them recently to see if I had a way of flagging items for inclusion on a specific VAT Daybook return. The script for setting transactions as already included on a VAT Daybook return was originally rejected, when we discussed requirements it turned out that it was the solution, but a little more work was required.

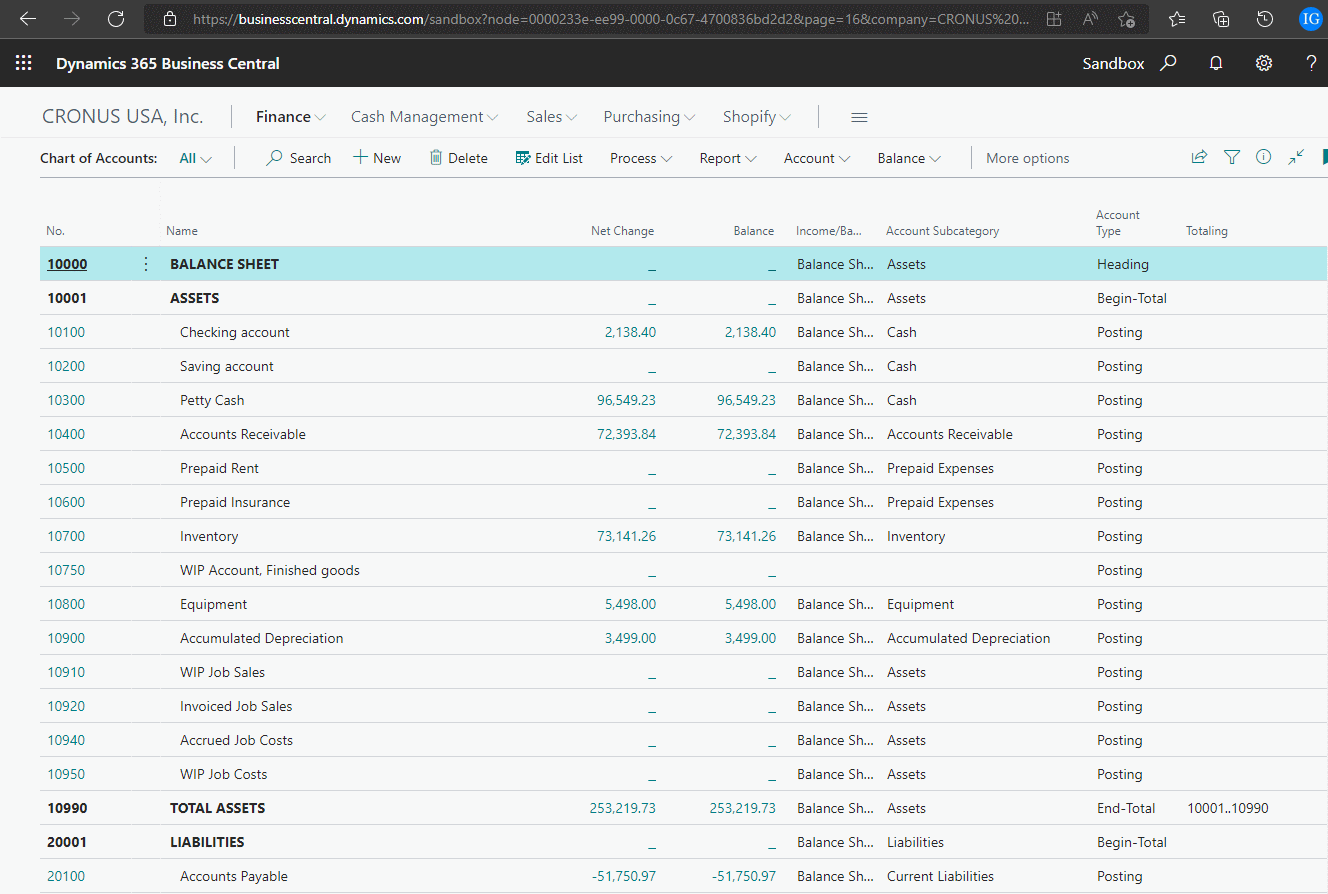

The issue was that a company was having the VAT Daybook enabled in a company which had never had VAT installed or configured before which meant transactions hadn’t previously been included in the VAT tables.

When the VAT Daybook module was installed transactions started being included. However, the first return which needed to be submitted was Q4, but with the VAT calendar created, there were all four quarters created.

To make sure transactions were only included in the Q$ return, the solution was multi-step:

- Use the script to flag all transactions as included on a VAT return.

- Run the Q1, Q2 and Q3 VAT returns.

- Run the script to remove the flag against transactions saying they had been included.

- Run the Q4 VAT return to pick up all of the required transactions.

Once the above was done, all future VAT returns can be processed as normal and they will include the correct transactions.