This post is part of the New Functionality In Microsoft Dynamics 365 Business Central 2022 Wave 2 series in which I am taking a look at the new functionality introduced in Microsoft Dynamics 365 Business Central 2022 Wave 2.

This post is part of the New Functionality In Microsoft Dynamics 365 Business Central 2022 Wave 2 series in which I am taking a look at the new functionality introduced in Microsoft Dynamics 365 Business Central 2022 Wave 2.

The eleventh of the new functionality in the application section is new VAT Date field on documents and entries.

Users can report VAT statements and returns based on the new VAT Date instead of the Posting Date to meet requirements by certain countries.

Enabled for: users, automatically

General Availability: October 2022

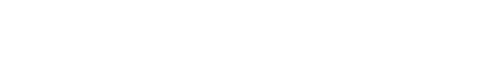

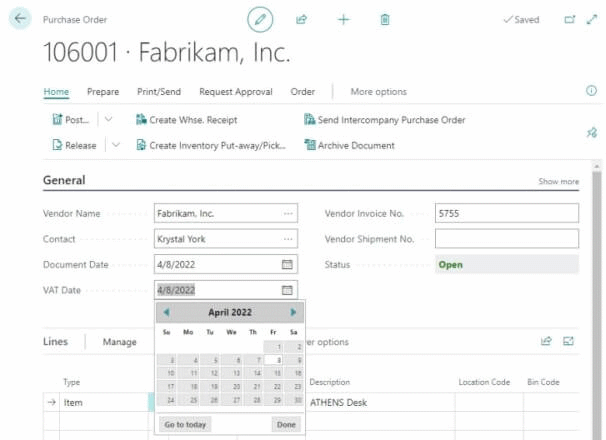

Some countries require reporting for VAT statements and VAT returns by using a date that’s different than the Posting Date. Sometimes, the date can be Document Date, but even this date can differ from the requirement. For this reason, the new VAT Date exists on all purchase and sales documents, as well as on journals. Before starting, users can set up the default value for VAT Date (Posting Date or Document Date) in the General Ledger Setup, but the date can be changed on individual documents and journals.

When a document is posted, the new VAT Date will be visible in VAT entries and in G/L entries. If necessary, it’s possible to change the VAT Date after posting.

My opinion

I’m surprised to learn that Dynamics BC did not already have a VAT Date field as, in my experience working with customers, the posting date is often not the date they would want to be using the the VAT.