This post is part of the Microsoft Dynamics GP Fall 2020 Release New Features series where I am going to echo the posts from the Dynamics GP Support and Services Blog, while adding some commentary, on the new features introduced in the Microsoft Dynamics GP Fall 2020 Release which is now available.

This post is part of the Microsoft Dynamics GP Fall 2020 Release New Features series where I am going to echo the posts from the Dynamics GP Support and Services Blog, while adding some commentary, on the new features introduced in the Microsoft Dynamics GP Fall 2020 Release which is now available.

This post is on the Non-Employee Compensation (NEC) for 1099 form Financial enhancement.

The IRS is releasing a new 1099 NEC form for the 2020 tax year; Non-Employee Compensation, which had been included in the 1099 MISC form, has been moved to its own form.

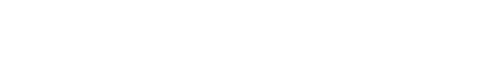

In the Vendor Card in Options, you now have the option of selecting Non-employee Compensation as a 1099 tax type. The Utility “Update 1099 Information” also includes selecting Non-employee Compensation.

To access the Non-employee Compensation tax type, choose Purchasing select Cards and then choose Vendor, once you choose a vendor click Options. In the Tax Type drop down menu, select Non-employee Compensation.

To make a Mass Update go to the Purchasing, choose Utilities and select Update 1099 Information, make the selections in this window for Tax Type From and To.

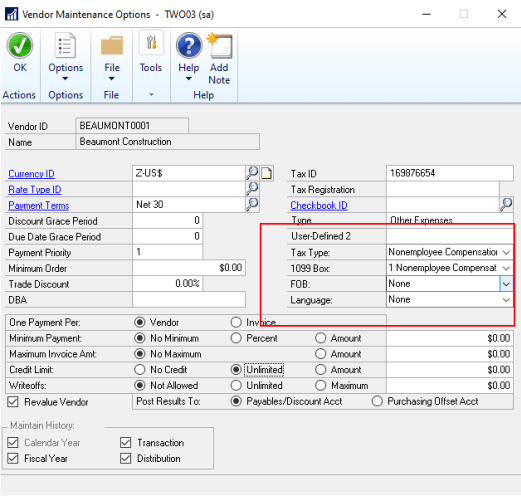

You can review the 1099 Details from the Purchasing home page under cards click 1099 Details:

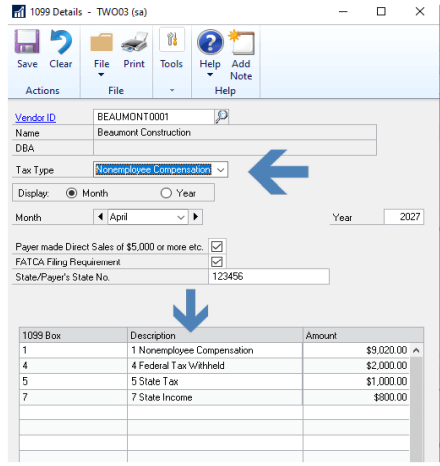

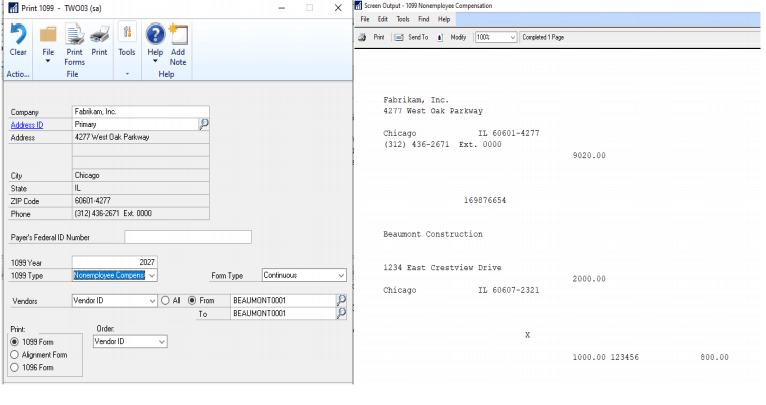

To print the form, from the Purchasing home page, choose Routines and Print 1099:

Click to show/hide the Microsoft Dynamics GP Fall 2020 Release New Features Series Index

What should we write about next?

If there is a topic which fits the typical ones of this site, which you would like to see me write about, please use the form, below, to submit your idea.