This post is part of the Microsoft Dynamics GP Fall 2020 Release New Features series where I am going to echo the posts from the Dynamics GP Support and Services Blog, while adding some commentary, on the new features introduced in the Microsoft Dynamics GP Fall 2020 Release which is now available.

This post is part of the Microsoft Dynamics GP Fall 2020 Release New Features series where I am going to echo the posts from the Dynamics GP Support and Services Blog, while adding some commentary, on the new features introduced in the Microsoft Dynamics GP Fall 2020 Release which is now available.

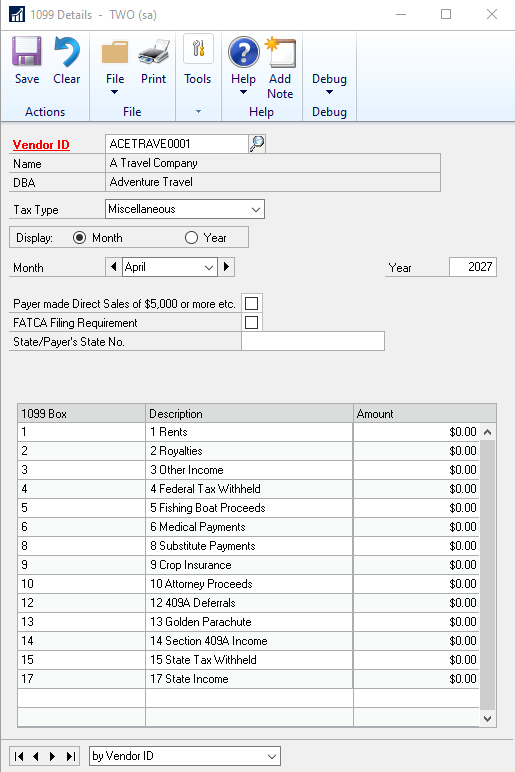

This post is on the 1099-MISC Updates Financial enhancement.

The 1099-MISC form has been revised to meet the IRS regulatory changes for the 2020 tax year. In the Vendor Card point to Options, point to Tax Type: Miscellaneous, point to 1099 Box, click the drop-down menu.

Box 9: Crop insurance proceeds are reported in.

Box 10: Gross proceeds to an attorney are reported in.

Box 12: Section 409A deferrals are reported.

Box 14: Nonqualified deferred compensation income is reported.

Boxes 15, and 17 report state taxes withheld, and amount of income earned in the state, respectively.

Box 7 was moved to the 1099 NEC form as a checkbox Payer made Direct Sales of $5,000 or more, etc.

Box 16 the state number is not a currency field and it is available at the header level of the 1099 details window. Therefore, the data entered in the header will be shown in the form.