With the release of Microsoft Dynamics GP 2016 R2 it’s time for a series of “hands on” posts where I go through the installation of all of it’s components and also look at the new functionality introduced; the index for this series can be found here.

With the release of Microsoft Dynamics GP 2016 R2 it’s time for a series of “hands on” posts where I go through the installation of all of it’s components and also look at the new functionality introduced; the index for this series can be found here.

The thirteenth Feature of the Day I am going “hands on” with is POP to FA Link to Include Taxes.

This feature will be popular with some of our clients who deal with non-recoeverable VAT (VAT is a UK sales tax charged at a standard rate of 20%) as non-rec VAT means they would need to depreciate the gross value of the asset including VAT where in previous versions the asset would be created net and need to be amended.

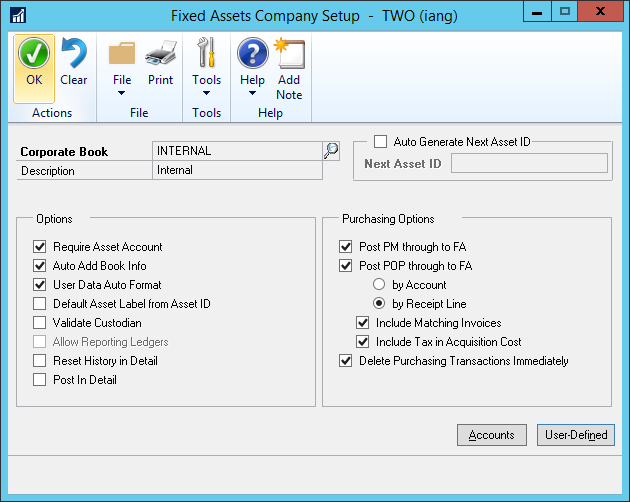

To use this feature, the Include Tax in Acquisition Cost checkbox on the Fixed Assets Company Setup window () under the Purchasing Options:

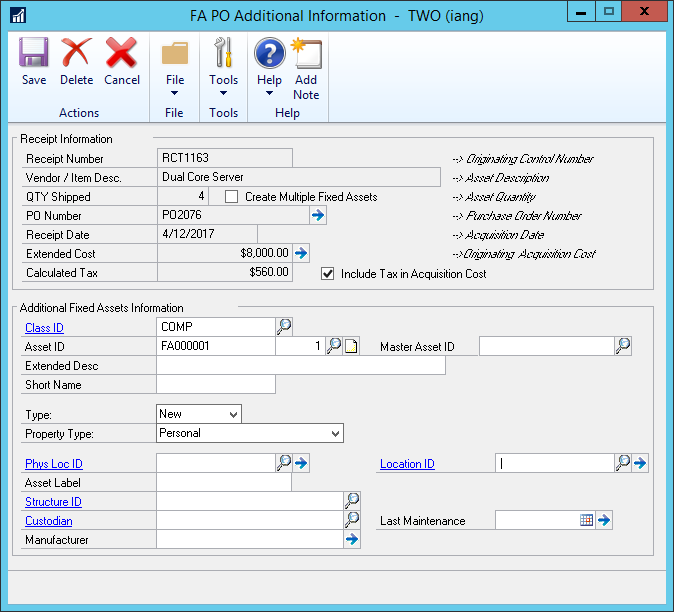

When a Receivings Transaction is entered (), the Include Tax in Acquisition Cost checkbox on the FA POP Additional Information window will be marked by default:

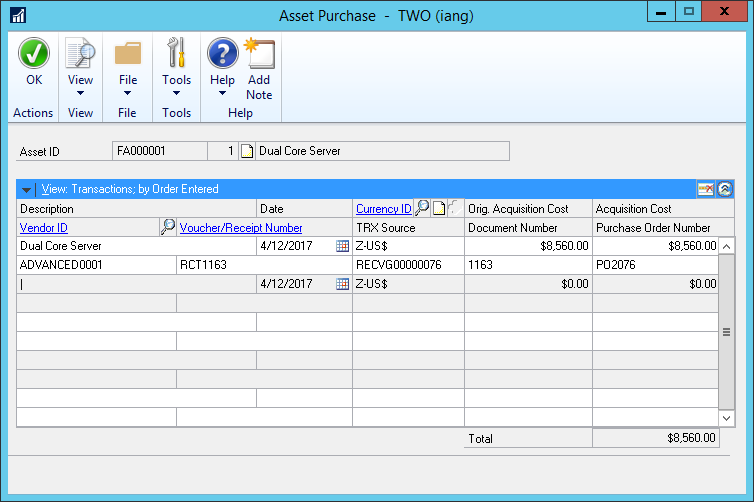

On the above screenshot the Extended Cost and Calculated Tax fields give a combined value of $8560, which is the value shown when the new fixed asset is created in the Fixed Asset General window ():

Click to show/hide the Hands On With Microsoft Dynamics GP 2016 R2 Series Index

What should we write about next?

If there is a topic which fits the typical ones of this site, which you would like to see me write about, please use the form, below, to submit your idea.

3 thoughts on “Hands On With Microsoft Dynamics GP 2016 R2: POP To FA Link Includes Taxes”