With the release of Microsoft Dynamics GP 2016 R2 it’s time for a series of “hands on” posts where I go through the installation of all of it’s components and also look at the new functionality introduced; the index for this series can be found here.

With the release of Microsoft Dynamics GP 2016 R2 it’s time for a series of “hands on” posts where I go through the installation of all of it’s components and also look at the new functionality introduced; the index for this series can be found here.

In this post, I’m going “hands on” with the sixth of the Microsoft Dynamics GP 2016 R2 Feature of the Day posts, Display Tax Percent for Historical Sales Transactions.

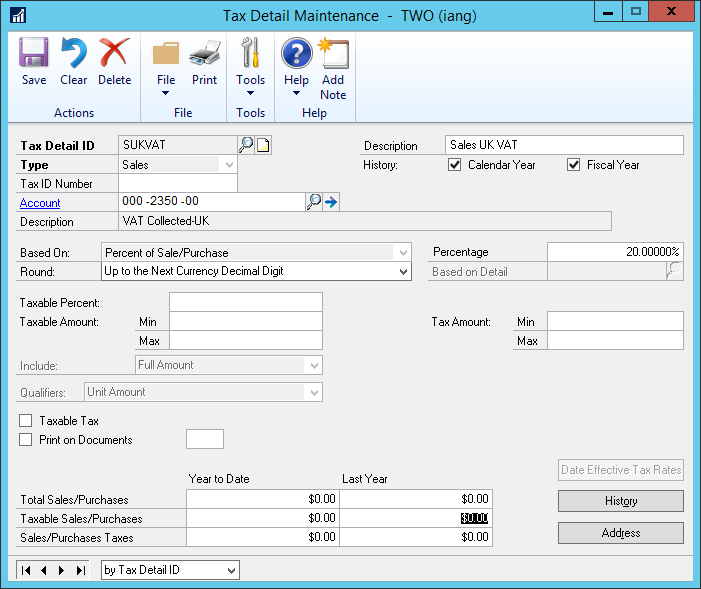

To test this feature, I created a new Tax Detail in Tax Detail Maintenance () for a Sales series Standard Rated UK VAT at 20% and created a related Tax Schedule:

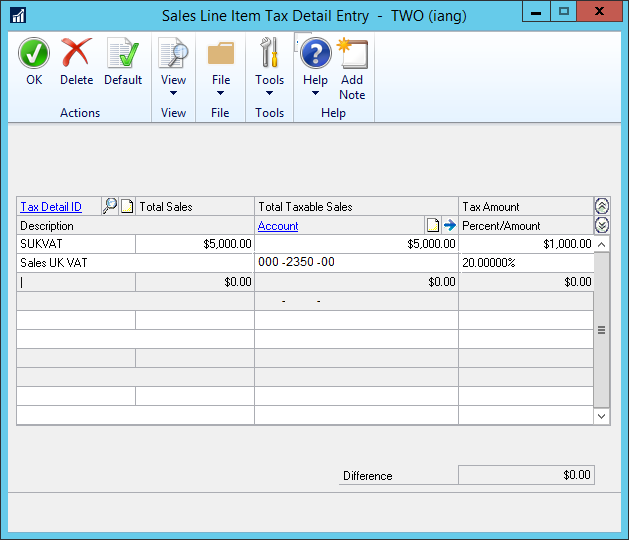

I then raised and posted a Sales Order and selected the new Tax Detail:

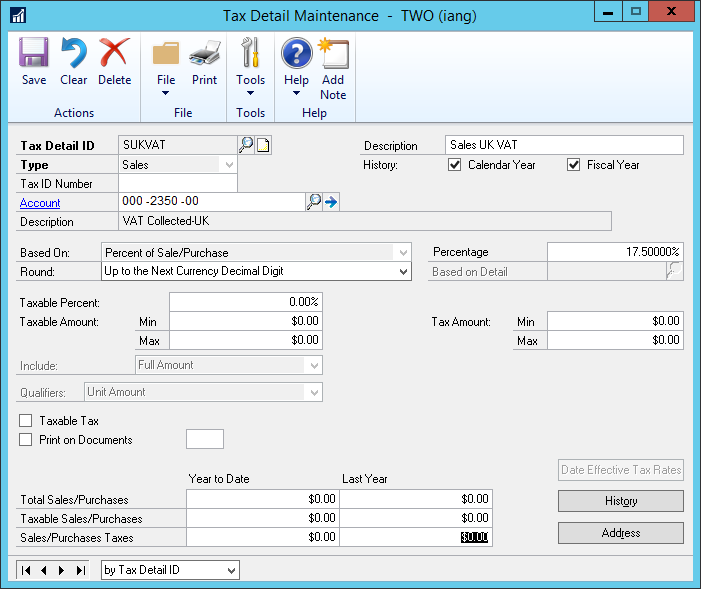

Returning to Tax Detail Maintenance, I reduced the tax rate to 17.5%:

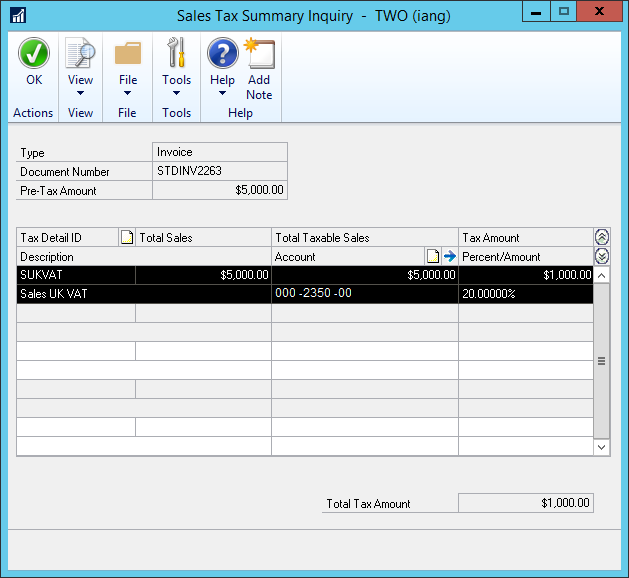

When I opened the Sales Document inquiry (), selected a document and expanded the Sales Tax Summary Inquiry window, the Percent/Amount column correctly showed the tax rate effective when the transaction was entered.

Unfortunately, if you’re using Date Effective Tax Rates, the Percent/Amount shown is the rate from the main Tax Detail and not the Date Effective Tax Rate.

Click to show/hide the Hands On With Microsoft Dynamics GP 2016 R2 Series Index

What should we write about next?

If there is a topic which fits the typical ones of this site, which you would like to see me write about, please use the form, below, to submit your idea.

3 thoughts on “Hands On With Microsoft Dynamics GP 2016 R2: Display Tax Percent for Historical Sales Transactions”