Over the last two or three years the VAT rate in the UK has changed three times; temporarily down to 15% from 17.5% and then back up a year later before a permanent rise in January 2011. On each occasion we issued advice to customers on how to handle these changes within Microsoft Dynamics GP; there were two ways for them to make the change; either create a new Tax Detail or amend the existing one. Personally I recommended the former as it is somewhat cleaner; you can tell at a glance what the VAT rate will be without the need to check the date the invocie was registered. If the latter option was taken users needed to remember which rate is effective on what date during the cross over period which means lots of scope for errors.

Over the last two or three years the VAT rate in the UK has changed three times; temporarily down to 15% from 17.5% and then back up a year later before a permanent rise in January 2011. On each occasion we issued advice to customers on how to handle these changes within Microsoft Dynamics GP; there were two ways for them to make the change; either create a new Tax Detail or amend the existing one. Personally I recommended the former as it is somewhat cleaner; you can tell at a glance what the VAT rate will be without the need to check the date the invocie was registered. If the latter option was taken users needed to remember which rate is effective on what date during the cross over period which means lots of scope for errors.

In Mirosoft Dyanmics GP 2010 a new feature has been introduced which can reduce these errors when using the same code; Date Effective Tax Rates. When setup, Date Effective Tax Rates allows tax rates to be configured with start and end dates and are used to override the tax rate defined on the main Tax Details Maintenance window.

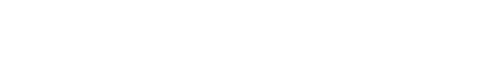

To use this new feature, the installation of Microsoft Dynamics GP 2010 needs to be modified to add the Feature;

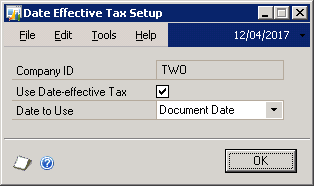

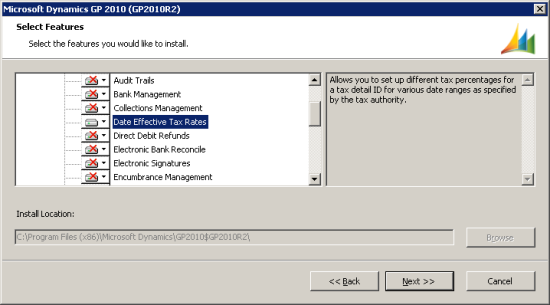

The next step, once the installation has been configured, is to enable the feature via Company Setup (Microsoft Dynamics GP menu » Tools » Setup » Company » Company) window’s Additional menu;

This opens the Date Effective Tax Setup where you can check Use Date-effective Tax and pick whether the Document or Posting Date should be used when picking the effective rate;

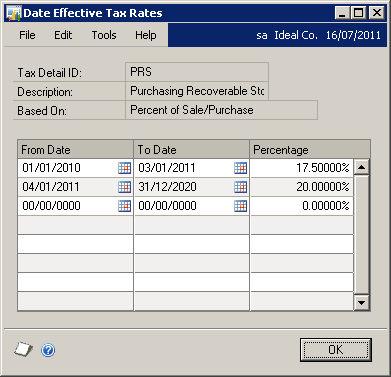

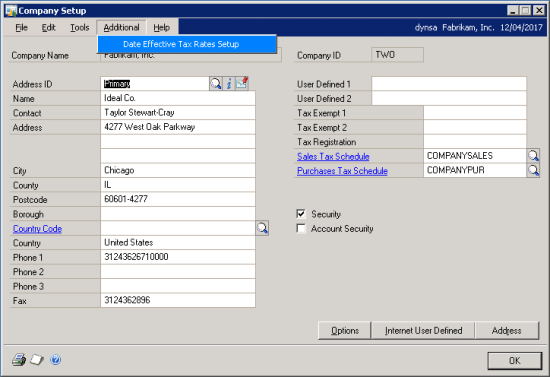

Tax Detail Maintenance (Microsoft Dynamics GP menu » Tools » Setup » Company » Tax Details) still maintains the default Percentage rate applicable to a Tax Detail and, via the Additional menu, gives access to the Date Effective Tax Rates window where teh date ranges and percentage rates are entered;

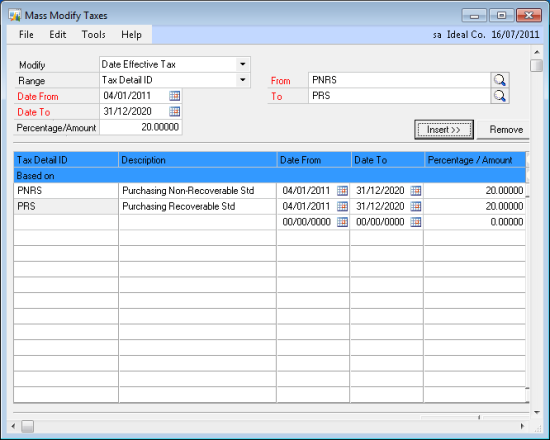

Mass Modify Tax Percentages (Microsoft Dynamics GP menu » Tools » Routines » Company » Mass Modify Tax Percentages) allows date effective tax rates to be applied to multiple tax details in one fell swooop;

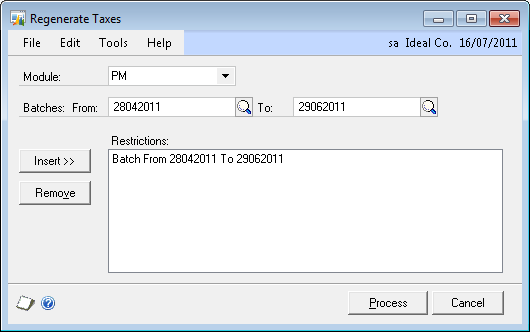

If you have made the cganges to the date effective tax rates late, the UK’s last VAT change occurred on the 4th January which meant some client sites were still closed on that date, the Regenerate Taxes window (Microsoft Dynamics GP menu » Tools » Routines » Company » Regenerate Taxes) can be used to change the tax on saved transactions;

Regenerate Taxes allows regeneration on all transactions or ranges of transactions in PM, RM, POP and SOP.

What should we write about next?

If there is a topic which fits the typical ones of this site, which you would like to see me write about, please use the form, below, to submit your idea.

Hi,

Thanks for your post. Do i have to change the install on all clients as well or only on the server?

No, this is a company wide setting so only needs to be done once per company.

Ian,

For some very strange reasons, I can’t seem to find this module in the most recent GP setups.. is it because it’s not available in the US / CA version of GP ? would I have to perform the whole setup from scratch by selecting an EU country ? I wasn’t able to find any useful documentation about the setup of this tool, but have a customer that has companies that are doing business in the UK & IE, thus they need the DETR module setup in 2018R2!

Thanks for your feedback on this.

Hi Beat,

You no longer select that feature during installation. I’m not sure if it is just there as standard or as part of VAT Daybook as I always install is module.

The Company Setup >> Options window has a checkbox to enable it.

Ian